Rule 1

If you are a beginner or have no market profits to your credit, trade only in an imaginary way rather than with actual money; if after reading Momentum Share Trader, you think that you have learned a great deal, prove it to yourself by buying and selling stocks but without money. Enter every purchase in a ledger, as though you had given an order to your broker. Add a half point for commission and taxes. Execute your buying and setting at a time you think most appropriate, as though you were playing for real money. Neither fool yourself nor your ledger. "Know thyself and unto thyself be true." After a few months of this type of trading, strike a balance sheet. Learn how many times you were right and how many times wrong. If the times you were right exceed the times wrong (not how much money you won or lost), go ahead and trade with money, but not with very much at the beginning. Ten shares are quite sufficient and if you profit, confidence in yourself will be built up. Thereafter you may increase your trading within your means.

Rule 2

Should you trade without first laying the foundation by a few years study of the scientific aspects of the market, you might as well set your mind to the inevitable result that a good part of your capital will be lost before you succeed. (That is Wall Street's usual charge for "breaking you in".) It is either by practice or study that you will learn how to trade. Naturally, in angling for experience, you will make plenty of mistakes, especially so if you are inadequately prepared. Therefore, if you have, let us say $1 0,000 at the time of your initiation; figure that you may lose a good part of it before you will make much headway, That is why I strongly urge preparatory study and training and to trade only in ten share lots in the beginning. Learn the market at the lowest possible tuition fee. You have time to play in 100 or 1,000 share lots after you have learned how to trade; and that may mean a few years. Should you start with 100 or 1,000 share lots, you may not have enough money left after you have learned. So start low and grow as you go along- Still better study first and trade later.

Rule 3

Do not deal in inactive stocks. Trade in live ones.

Rule 4

Do not hold on to a stock if the trend is against you. You may be able to buy more stock later for the same money.

Rule 5

Do not be overly enthusiastic about your prospective profits, they may never come, or when they do may disappear because of "pride of opinion" or "hope, "Hope is your worst enemy in the market.

Rule 6

Do not trade with someone else's money, whether your brokers or your friend's. Do not trade with money, which you can ill-afford to lose. Before attempting to trade, make certain that all your obligations are taken care of.

Rule 7

If you attempt to make money in a hurry, you will not succeed'. 'There is money in Wall Street for you - If you do not get it today, it is there for you a week or month hence. You have a better chance to get it, however, if you wait'. Trade when the TIME is ripe. (Patience is a prime requisite for successful trading.)

Rule 8

Do not be discouraged if you make a mistake. The best traders make them. But learn to profit from those mistakes and try never to repeat them. Attempt to find out the underlying cause. When you have thoroughly reasoned out what you did or failed to do, resolve not to repeat the same error again. Do not place faith in luck. If you think it is luck that makes the market fluctuate, you will never be a successful trader. There are reasons why the market goes up and down, and it is up to you to find them out. (We all make mistakes but only a fool or a weakling repeats them.)

Rule 9

Be skeptical about any trade that appears to be a dead-sure winner. When you are one hundred per cent certain that you will come out ahead that is just the time to look about with a critical eye. The market may have many surprises in store for you. (More people get stung by sure things"' than by bees.)

Rule 10

Do not guess the market. Trade only AFTER you have come to definite conclusions. By an analysis of the situation. Do not arrive at these conclusions hastily. Measure every possible angle first, such as fundamental economic and political conditions-the trend, Dow theory, and the signals from your charts. When these are in your favor, determine if it is the psychological moment to act.

Rule 11

Bear in mind that the market is in the strongest technical position when it is 'Weak' with Prices down and news gloomy. It is in an, extremely weak position when it appears to be strongest, as when prices are up, business booming, and newspapers full of prosperity psychology. Following the theory of cycles, it works out thus- the strong factors have potential weaknesses, which must assert themselves sooner or later;

Forces, which are momentarily weak, possess potential strength. Following logic, it works out thus: When the market is strong, and the press is filled with rosy prospects (indicating prosperity), the news or happenings, which influenced the market to go up, has already materialized. Therefore it is most unlikely that the market will go higher. On the other hand, when the market is weak, from the standpoint of price, it is in a position to discount good news, which may be in the making.

Remember then that when good news is out, and the market high, the combination of "cause and effect' has completed its mission. Because the news was good the market went up. Likewise, when the market is down the combination of "cause and effect' has reached the end of the effect. Because news was bad the market went down. To profit by stock market action you should buy before the "cause is known-that is, before news is out. You will then be in a position to realize on the effect to come-namely, higher prices (Remember what Jesus said about the strength of those who are weak and about the weakness of those

Rule 12

If you want to come out ahead, do not repeat your mistakes. In that way you will eventually succeed. Remember, also, that the market always gives you a thousand and one opportunities for new errors. So be on guard!

Rule 13

It is advisable to trade in not more than ten stocks. Study these stocks painstakingly, their actions for months back, there resistance points, and their behavior, so that you may know exactly what they are capable of doing.

Rule 14

Do not "average" your stock if it goes against you. Do not buy more of the same stock at a lower price if it has already dropped. Close it out instead.

Rule 15

Place your "stops" so that they will be 1/4 below even figures on a "long" buy, and a 1/4 above even figures on a "short." Place your stops below resistance points on a "long" buy and above resistance points on a "short' sale. The study of resistance points on individual stocks and on the Averages is of utmost importance.

Purchase or short sale when that point is reached, sit* sell out. In all probability you would be doing better than "'they." Do not confuse this procedure with stop-losses placed to protect profits on a stock purchased or shorted. In such cases, place your stop loss orders with your broker and move them up gradually as the stock advances so as to protect the additional profits, which have accrued.

Rule 16

Success in speculative operations on the Exchange is based on the following. First, on your ability to determine economic and political conditions, not as they are today, but as they will be three to six months hence. Second, on your ability to determine what "they' in Wall Street are doing or intend to do with the stocks they have on hand or with the stocks in the hands of the public.

If, after a thorough -study of the situation, you decide that they are interested in buying, then do the same as if you suspect they are disposing of their holdings. Do likewise. Go short if you detect the move at the top. Follow them and you will succeed. Buck them and you wilt fail.

Rule 17

Begin a trade with the expectation that your profits shall be four or five times your risk. If you anticipate only a two-point rise, do not buy. Wait until your analysis shows a possible advance of 8 to 10 points. Then risk two points on a five to one shot. This is much better than a one to one chance. Theoretically, it means that you should trade only on intermediate trends and not on minor trends.

Rule 18

Money can best be made when buying on the down of a move and then selling close to the top. If you have predetermined by analysis the resistance points on the particular stock you are dealing in and on the Averages, the possibility of error is limited.

Rule 19

Purchase stocks in the strongest groups only. As a general rule some groups are stronger than others. At a time tech may be strong and oil weak. Trade in the strongest groups for a rise. This you determine from the market action its-self. In each sector there are always a small number of stocks that perform the best. Your job is to recognize these stocks and profit from them.

Rule 20

Trade evenly. Always keep your risk the same in every trade. It's tempting after a number of wins to really go for it. Yet this is when you are most likely to have a loss. Taking a loss when you are over extended is not good money management.

Rule 21

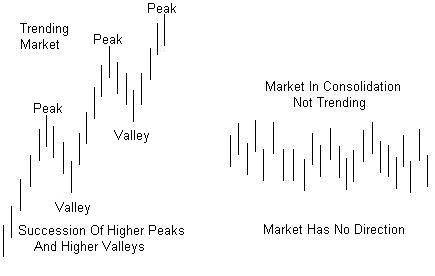

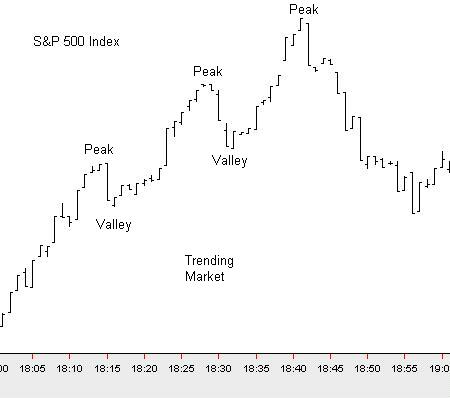

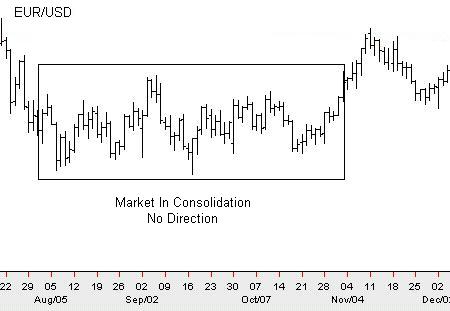

The most important thing to know about the market is the "trend." Do not attempt to trade until you are certain of the direction of the trend by a thorough analysis. Always trade with the trend and not against the trend. If the trend is doubtful, stay out of the market entirely until it is visible, even if it should take weeks or months. You will be well compensated by not trading in a market of which you are in doubt. Money is not made by being in the market on all turns. (In fact that is a good way of losing it.) A few selective trades per year by thoroughgoing analysis will net you more than trading day in and day out by guesswork in other stocks, which are in their technical up-move. The study of "technical" positions of individual issues is both vital and interesting.

Rule 22

Learn to be patient Guard against hurry-skurry (get rich quick). If you have calculated

that your stock will move up a certain number of points and you think that you are correct in your analysis, have the patience to wait. Your opportunity may arrive a few days after you have sold out your stocks at a lower figure. The test of a good trader is the degree of PATIENCE he can muster. (The world might very well have been destroyed in the days of Lot if the good Lord were without Patience. So says the Book of Books.)

Rate 23

Do not permit your opinions about political matters to influence your market judgment. You may have a soft spot for the underdog and sympathize with the New Deal. But during market hours consider President Roosevelt's speeches and actions objectively so that you may gauge every possibility and reaction. 'Learn to exercise professional judgment. Do not allow political wish fulfillment to interfere with your stock

.

Rule 24

When the tape has been going in a certain direction, either up, or down, and it comes to a stop for a few days that usually signifies that a new chapter is starting. Sometimes it may be a stronger continuation in the same direction. More often, however, it indicates that the market may soon turn in the opposite direction. (For "tape readers" only.)

Rule 25

Remember that the reason stocks go up and down is basically because of supply and demand, If there are more buyers than sellers, stocks will go up, even though they were heading downward. Some may wish to sell, but if those who buy are more numerous or have more purchasing power, stocks naturally will go up. When stocks do go up, it is because people went to pay the higher price. In other words, the demand is greater than the supply. When a point is reached where there are no more buyers at the prices asked, then the demand has diminished. From that point on a decline will take place. With this in mind, act accordingly. When you notice that the supply is greater than the demand, sell. You cannot be certain how for they might go down, because you cannot measure how great the supply is and whether the demand shall be strong enough to stop this supply. The time to replace your stocks is when you are certain that demand has overcome supply. (For "tape readers" only.)

Rule 26

Do not ride up and down with a stock indefinitely. You may have bought with the idea that it will go up ten points. But that is no reason why you should not take profits beforehand. If they are available. If you bought at 100 with the object of selling at 110 and followed up to 105, (half way) a corrective reaction may be in order, as it may wish to test the 102-103 level. Is there any reason why you should let it ride down on you? Since the commissions are, approximately only a half point, the wisest thing then to do is to sell at 105, buy back at 102-103-104 or even 105. Do not stay on while it is reacting as it may go below 100.

This gives the in-and-out trader the following advantages:

1. An opportunity to buy for less, thereby making additional profits.

2. Taking no chances while it is slipping on the way down

3. If the stock should react to 103-104 and then shoots up to 106, it is a safer buy at 106. It has already gone through the reaction and consequently has a clear road ahead. (Remember, you cannot marry a stock on buying, nor do you pay alimony on parting.)

Rule 27

Watch commodity prices especially wheat and cotton. Take particular note of bank issues. If they go down, most likely all other stocks will go down, a sharp drop in commodity prices usually foretells a drop in stock prices. Another item to watch is foreign selling. During 1937 there was considerable foreign buying and selling. The buying was during the beginning of the year and the selling during the latter part. Many breaks in the market were attributed to foreign sailing.

Rule 28

It is advisable to place, a time limit on stocks. If a stock does not come up to your expectations within a certain time, sell, even at a loss. You cannot afford to have your capital tied up for too long a period. Meanwhile you may be losing out on opportunities if you had invested. Especially true in momentum trading. If your stock does not show you a profit after THREE weeks get out! Something is not right.

Rule 29

Do not take money out of your business for trading on the market unless your business can unquestionably do without it. Do not trade if it will

cause you too great anxiety. You will never succeed in that state of mind

Rule 30

Do not try to squeeze your stock for the last quarter or half Point. If You have made a substantial profit, it is best to cash it.

When the market reaches the stage where you think it is forming a top, it is then advisable to actually place a stop-loss order with your broker fractionally below the last sale. In this way you take no chances. Should it Happen that the stock moves higher-a procedure most likely, since at that level the public usually enters the market to give the stock a further push-up-you will gain the additional point or two that the stock may make. At the same time your paper profits will be protected.

Rule 31

When you decide to take profits by selling, do it on the up-move, while the stock is climbing. Do not wait until the movement exhausts itself, as you will then have to sell for one-half or one point less. (Strike while the iron is hot)

Rule 32

When the market is in an up-trend and you wish to take advantage of a little shakeout to come, trade short, but only with a small % of your profits from the long trades.

Rule 33

When buying on a reaction, it is best to place orders at stipulated prices

under the market instead of "at market." When buying while the market is advancing it is best to buy "at market," as otherwise you may not get stocks at your price and an opportunity may be lost.

Rule 34

It is very important that you know before buying or selling where the resistance point is on the Averages (Dow-Jones or others) and on the stock you are trading in. For instance- if your records show that there was a good deal of resistance at 102 on Steel, you should not buy Steel at 101, as it may sell off at 102. You should buy at 95, by following it up to 102 and then selling, you can make a profit. The same is true for the Dow-Jones Averages. If on previous occasions there was a resistance at 190 on the Dow-Jones Averages, sell at 189.

SOURCES : Mark McRae